There are several ways you can determine your employee relationship with Deel.

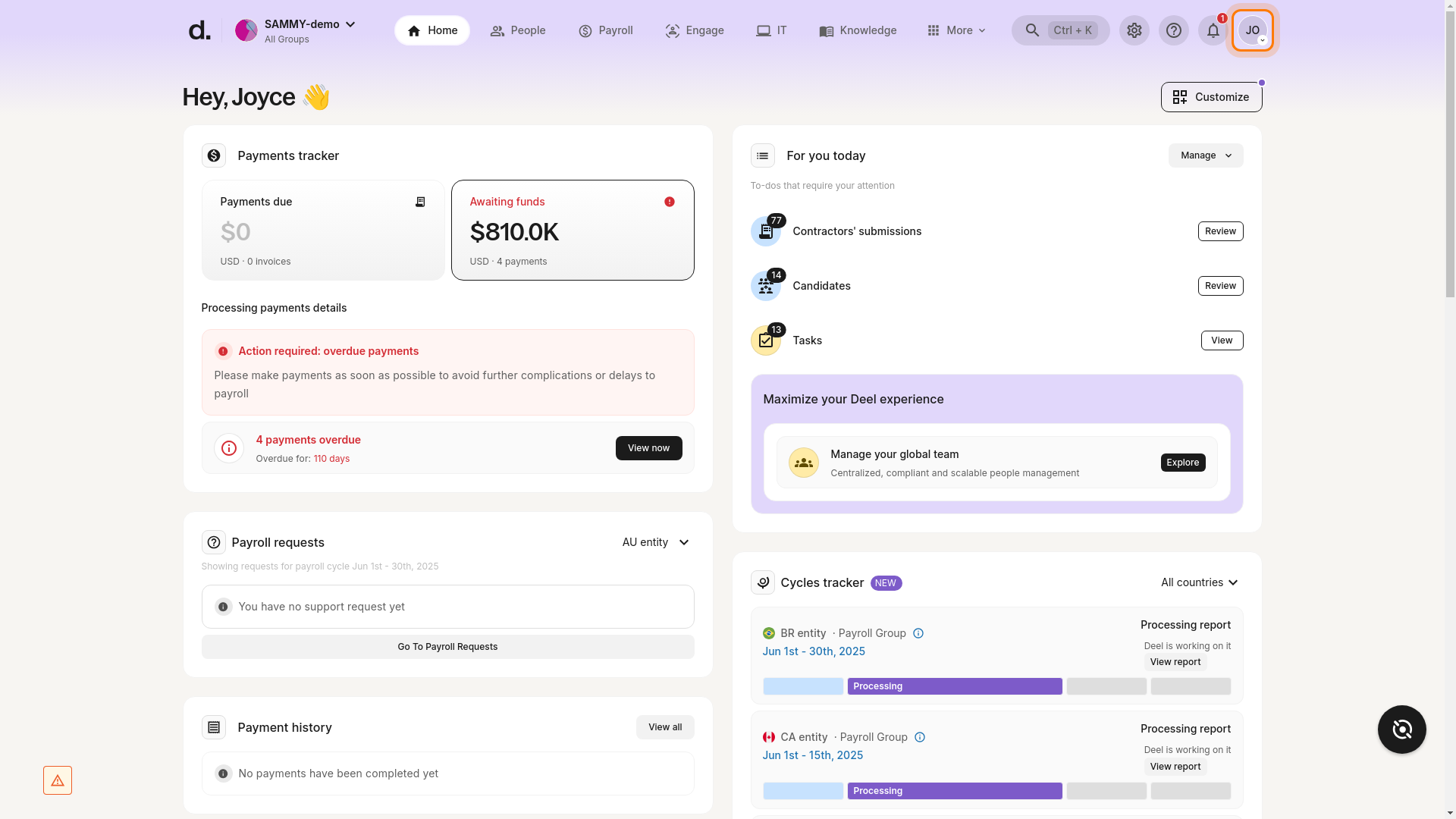

1. When logged into your Deel account

You can find your worker (account) type directly from your profile.

Estimated time: 2-3 minutes

Prerequisites

• You are logged in to your Deel account.

Option A – From the left navigation panel (Contracts / Agreements view)

- In the left menu, click Your Profile.

- In the Contracts / Agreements card, locate the Worker Type row.

This section also shows the Group you belong to and your job title.

Option B – From Profile settings (recommended)

Follow these steps if you don’t see Your Profile in the left menu, or if you prefer a faster route.

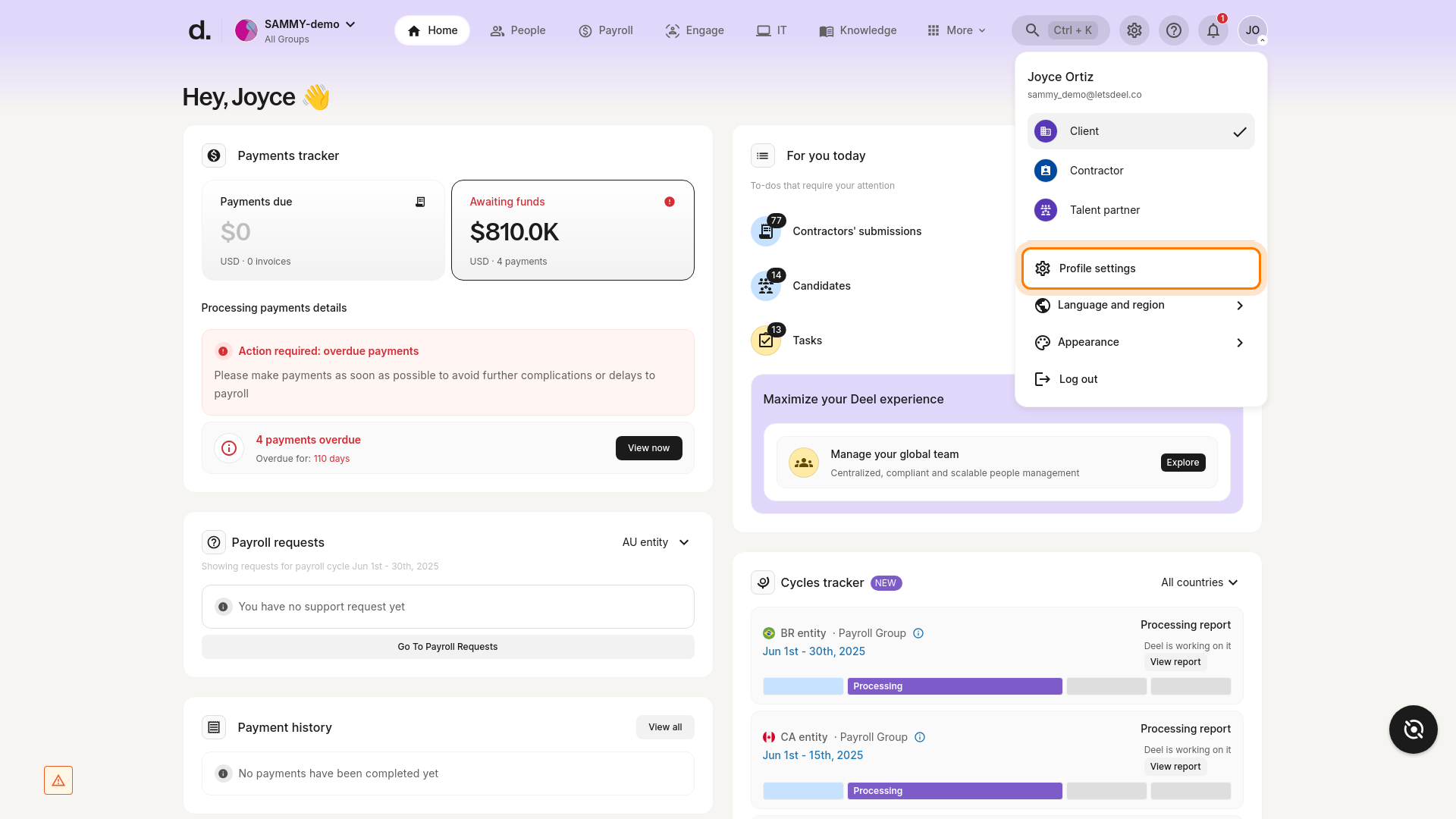

- Open the user menu

Click your avatar (profile icon) in the top-right corner of the dashboard.

- Navigate to Profile settings

In the dropdown, select Profile settings.

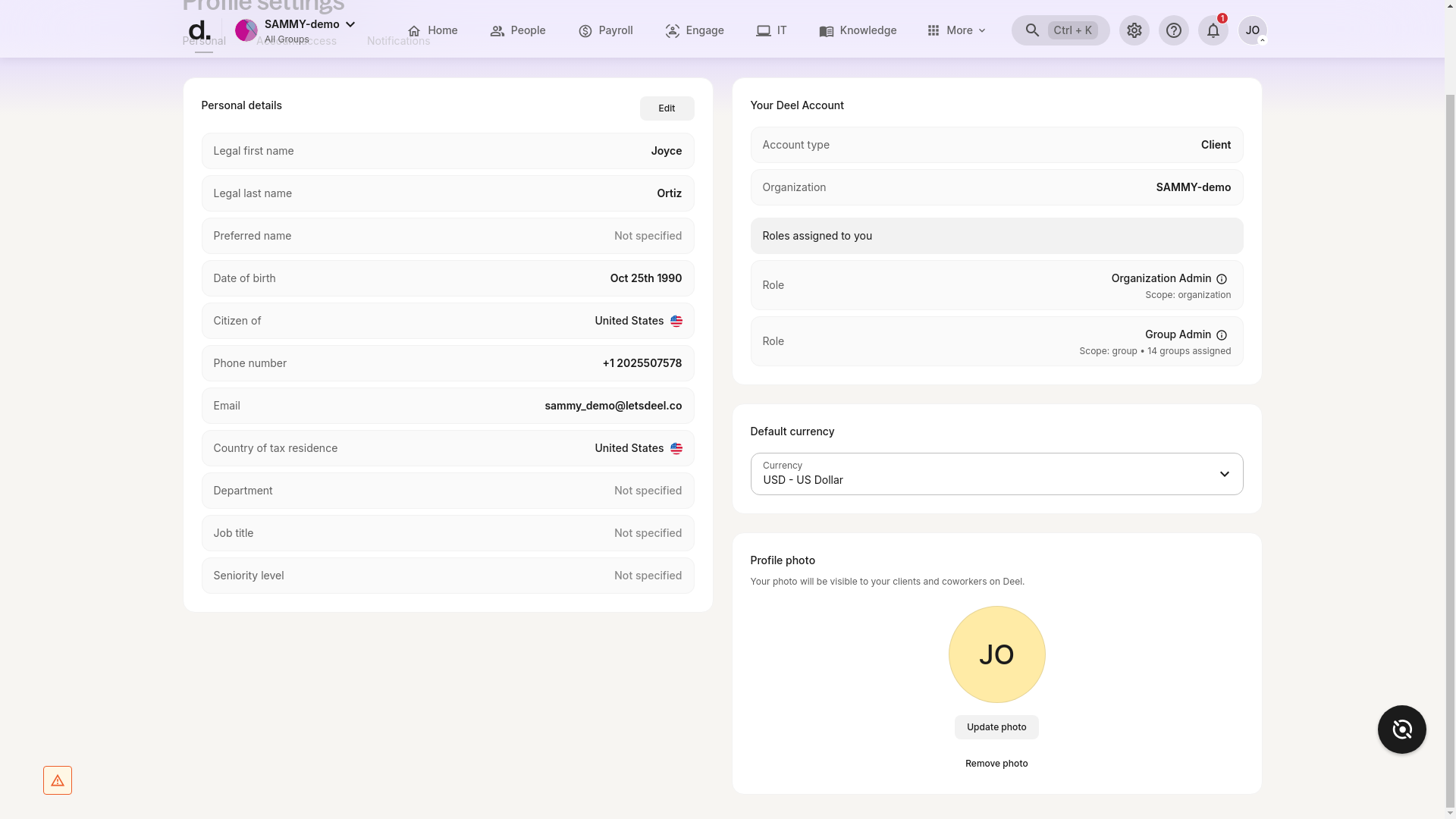

- Locate your worker type

On the Profile settings page, look for the panel titled Your Deel Account.

The Account type field shows your current worker type (for example, Client, Contractor, EOR employee, etc.).

- Verify

When you can see the Account type value, you have successfully confirmed your worker relationship with Deel.

Troubleshooting

• Profile settings option not visible? Try refreshing the page or logging out and back in.

• Account type missing? Scroll to ensure the entire Your Deel Account panel is visible. If it is still missing, contact Deel Support.

2. When reviewing your contract

You can also determine your employee type by checking the language in your contract agreement:

• EOR employee – The role appears as EOR, EOR – Annual, or EOR – Hourly.

• Global Payroll Direct Employee – Your contract states Direct Employee – Payroll.

• Deel HR employee – The worker type is simply Direct Employee.

3. What is the difference between employee types?

EOR employee

If you are an EOR employee, Deel is your legal employer and serves as the Employer of Record (EOR). Deel runs payroll, ensures compliance with local laws and labor regulations, and handles additional administrative HR tasks while you perform your work for the client company.

Direct Employee – Payroll

If you are a Direct Employee – Payroll, Deel only runs your organization’s payroll; we are not your legal employer. Your company hired you directly through its own legal entity. Deel processes payroll, delivers payslips, and (where required) issues end-of-year tax documents. In some jurisdictions Deel can disburse funds on your employer’s behalf; in others, your employer will pay you directly.

Direct Employee

If you are a Direct Employee, you are legally employed and paid by your company, but your contract and HR data are managed on the Deel platform (Deel acts as your company’s HRIS).

PEO employee (USA only)

If you are a PEO employee, you are in a co-employment relationship: you are legally employed by both your organization and Deel. Deel handles payroll and HR duties as a Professional Employer Organization (PEO) for small businesses in the United States.