Deel Wallet is a payment account available to Deel workers in the US. With Deel Wallet contractors can seamlessly spend and transfer funds, without the need to withdraw funds to an external bank account or other wallet.

Deel Wallet will replace Deel Balance for US contractors while providing more functional payment features.

All contractors with US tax residency and residing in the US will receive their pay directly to their Deel Wallet.

Deel Wallet also allows workers to:

- Hold funds with Deel for unlimited length of time

- Send money domestically in the US to personal, friends, and family accounts (applies only to transfers from the Deel Wallet in the US)

- Receive passthrough FDIC insurance* (up to $250k provided by Community Federal Savings Bank, Member FDIC.)

- Access monthly statements and transaction reports

In This Article

- Availability

- How Does Deel Wallet Work?

- Guide for New Contractors

- Guide for Existing Contractors

- Frequently Asked Questions

Availability

Deel Wallet will replace Deel Balance for all Independent Contractors who have US Tax Residency and who reside in the United States (have a US address) and their clients.

This does not include Independent Contractors who are covered by a Contract of Record (Deel Shield).

How does Deel Wallet work?

Contractors with US tax residency and who reside in the US will receive an account created through Deel partner Alviere, the service provider for Deel Wallet. Deel Wallet can be accessed via Deel account by navigating to the home page.

Contractors will review and accept the terms for Deel Wallet during their onboarding with Deel.

Once the terms have been agreed to, contractors will be able to access their Deel Wallet from the home page.

New Contractors:

Accessing and Using Deel Wallet

The Deel Wallet balance will appear on the contractor’s home page.

✅ Select Transfer to access options for moving funds.

✅ Select Add New Account to enter and save details for at least one account where funds can be transferred.

Withdrawing Funds

Please Note: Funds are made available the next business day unless the transaction is under review or additional information is required to complete the transaction

✅ Select Transfer to access options for moving funds.

The full balance available in the wallet will be selected by default. Contractors can opt to enter a custom withdrawal amount if they prefer.

✅ Select the account where the funds will be transferred.

The Total Summary on the right will display the Transfer Amount, Transfer Fees, and Date Available.

Deel will deduct transfer fees for the account selected from the transfer amount.

Click to expand the Date Available for a breakdown of the transfer processing steps.

✅ Select Transfer and review the details before selecting Confirm Transfer to submit.

Track and Review Transactions, Download History and Statements

Contractors can track and review all of their wallet transactions directly in Deel. They can also access monthly statements and download their transaction history quickly and easily.

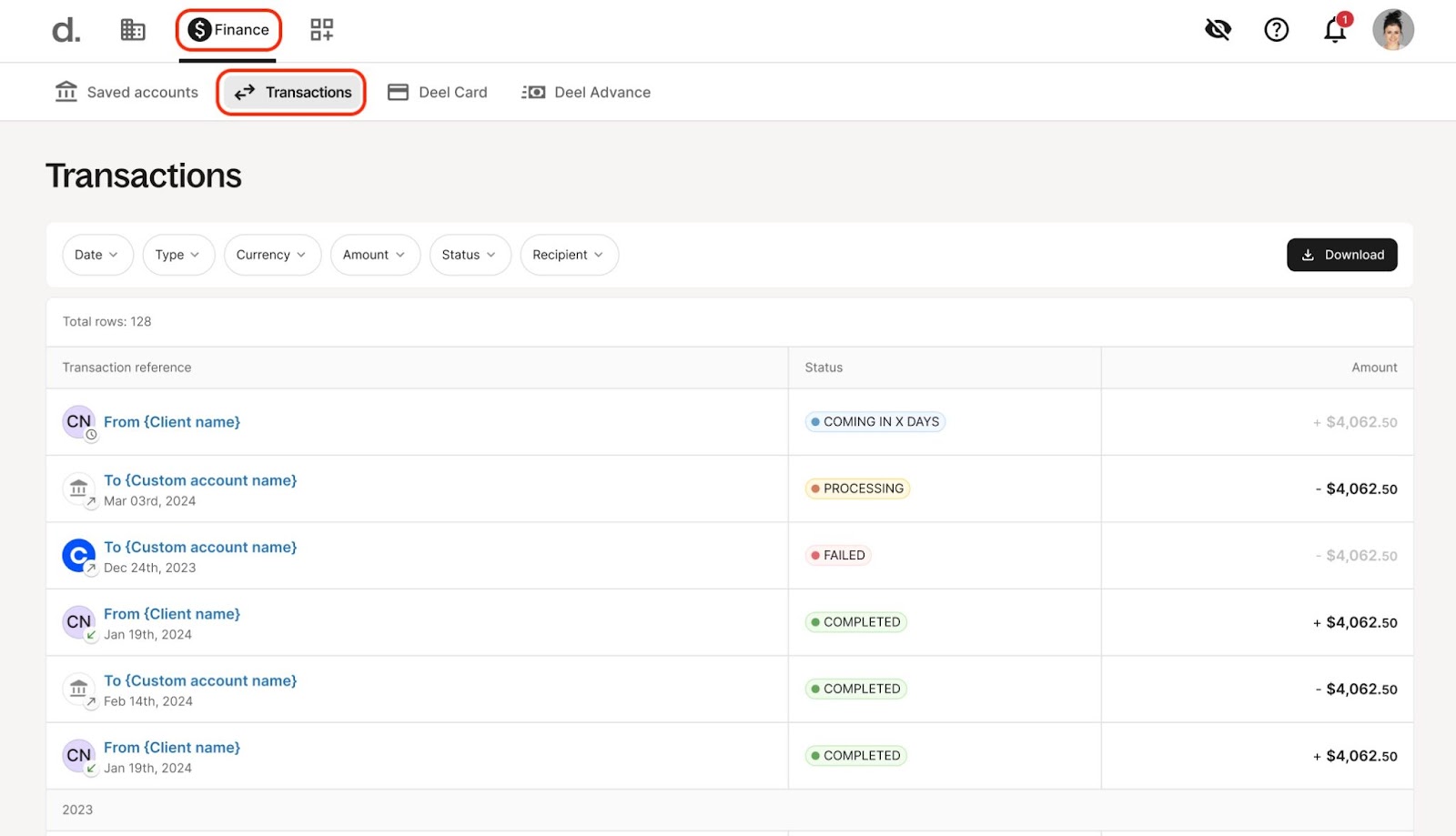

✅ Select the Finances icon followed by the Transactions tab.

Click each Transaction Reference Name to review transaction details and access the Transaction Receipt.

Each transaction in and out of the wallet will be listed with the processing status and amount.

✅ Click Download in the top right to access the menu.

✅ Select Download table as CSV, Download table as PDF, or Download Monthly Statement.

Existing Contractors

Existing US contractors will be prompted to review and accept the terms and conditions, e-sign consent, and privacy policy for Deel Wallet at launch.

Once the terms have been agreed to, the contractor’s “Balance” will be displayed as their “Wallet balance”.

Accessing and Using Deel Wallet

✅ Select Transfer to access options for moving funds.

✅ Select Add New Account to enter and save details for at least one account where funds can be transferred.

Please Note

- Deel Wallet only operates in US dollars. All contracts for contractors with US tax residency who reside in the United States that are currently paid in a foreign currency will be converted to payments in US dollars. '

- Withdrawal methods saved in Deel Balance will not migrate to Deel Wallet, with the exception of ACH Local Bank Transfer methods

- US Clients will be provided with new account details through which to pay their US contractors separately from their non-US contractors

Frequently Asked Questions

[ACCORDION] Why is Deel Balance becoming Deel Wallet?

Deel Wallet replaces “Deel Balances”, providing more functional payment tool to contractors with a tax residence in the United States.

[ACCORDION] What is Alviere? Is Alviere a bank?

Alviere is a licensed money transmitter (NMLS ID No. 1738907) and/or an agent and service provider of Community Federal Savings Bank, Member FDIC.

Alviere is partnered with Deel to provide a compliant and feature rich wallet account to US contractors.

Because Alviere is a licensed payment institution the Deel Wallet can offer contractors benefits including cross-border remittance, monthly statements, and passthrough FDIC insurance up to $250k!

Note: Deel is not a bank. The Deel Wallet and any financial services related to the Deel Wallet are provided by Mezu (NA), Inc. dba. Alviere as a licensed money transmitter (NMLS ID No. 1738907) and/or as an agent and service provider of Community Federal Savings Bank, Member FDIC. The FDIC insurance referenced above is passthrough insurance provided on accounts held at Community Federal Savings Bank.

[ACCORDION] How secure is Deel Wallet?

Deel Wallet is a secured prepaid account opened for US contractors by Community Federal Savings Bank ("Bank"), a member of the Federal Deposit Insurance Corporation ("FDIC"). Mezu (NA), Inc. dba Alviere (“Program Manager”), is the Bank’s program partner responsible for managing the Card and Prepaid Account and its related services (the “Services”) and providing customer service on the Bank’s behalf. Alviere is a licensed financial institution and money transmitter in over 45 U.S. states and territories.

[ACCORDION] Who will have access to Deel Wallet?

Deel Wallet will be available to all contractors with US tax residency who reside in the United States that are not covered by Contractor of Record.

To begin using this feature, US contractors & clients need to accept the T&Cs to get verified by our trusted partner who powers the Deel wallet.

[ACCORDION] Is Deel Wallet Required?

Yes, all contractors with US tax residency who reside in the US and are not covered by COR and US clients who use contractor service will be required to use Deel Wallet.

[ACCORDION] Can clients pay contractors in different currencies using Deel Wallet?

No, all US contracts must be paid in USD only. All contracts where the worker has a US tax residence that reside in the US will automatically be converted to payment in USD. All new contracts where Deel Wallet is applicable will be created in USD.

US Clients will be provided with new account details to pay their US Contractors separately from other services like EOR, GP, COR etc. .

[ACCORDION] What happens to funds in the contractor’s balance that is not in USD?

Deel wallet only allows funds to be received or held in USD. When Deel Wallet becomes available, contractors holding funds in different currencies will have the option to withdraw or allow Deel to convert the funds to USD. Funds are converted at a mid market rate without any fees.

[ACCORDION] What countries can contractors send international remittances to using Deel Wallet?

Deel is constantly adding to the list of countries and currencies where contractors will be able to send funds. A full list of supported locations and currencies will be provided shortly!