Overview

This guide provides step-by-step instructions for accessing and downloading quarterly tax forms from the Deel platform. You will learn how to navigate to the correct section, verify the availability of tax documents, and understand what to do if no documents are available. Screenshots are included to illustrate each major step.

Prerequisites

- You must have the necessary permissions to access payroll and tax documents within your organization’s Deel account.

- At least one quarterly tax document must be published and available for download. If no documents are available, you will not be able to complete the download step.

Step-by-Step Instructions

- Navigate to the Payroll Section

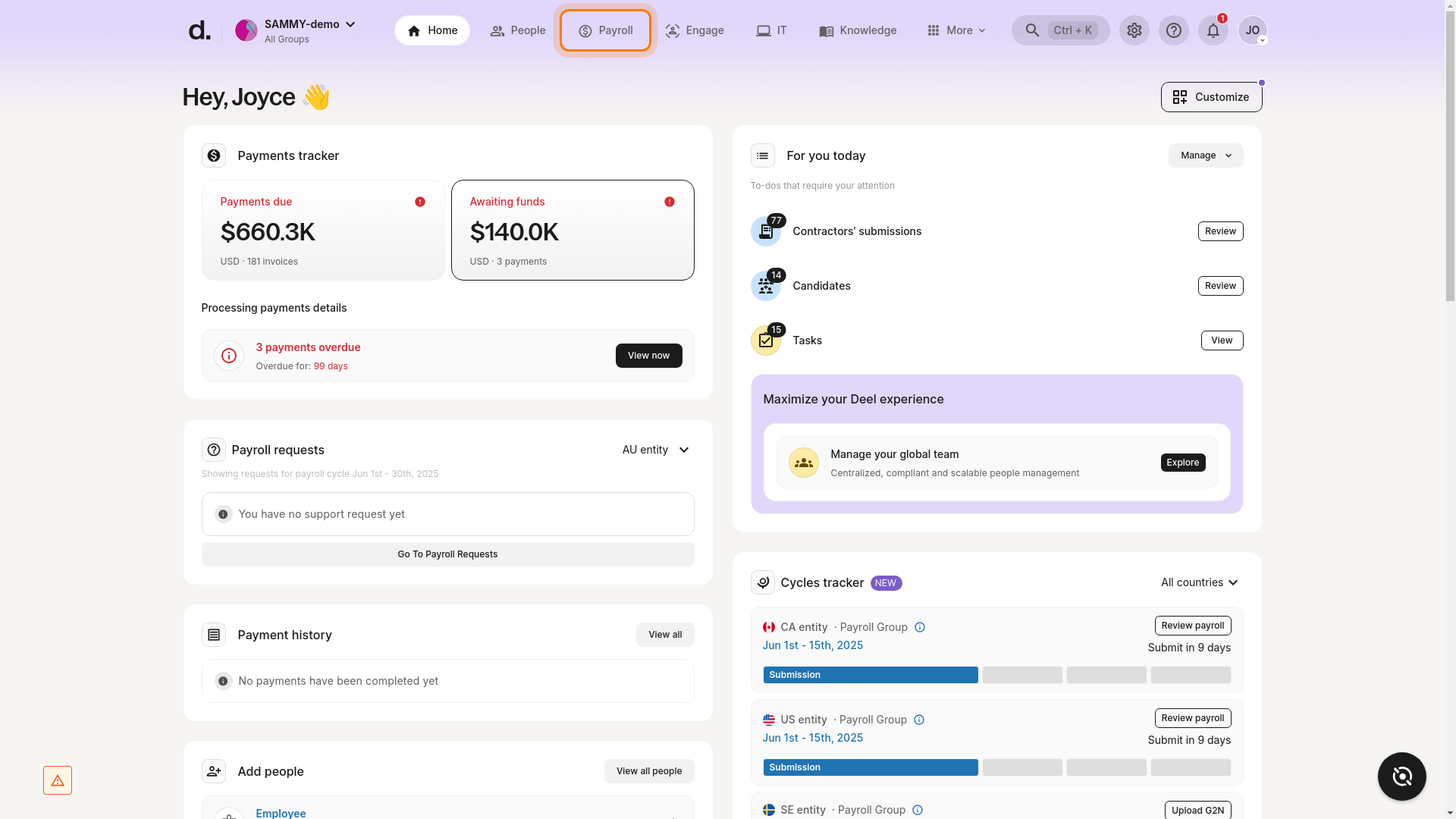

- From the Deel dashboard, click on the Payroll tab in the main navigation bar at the top of the page.

- Access Tax Documents

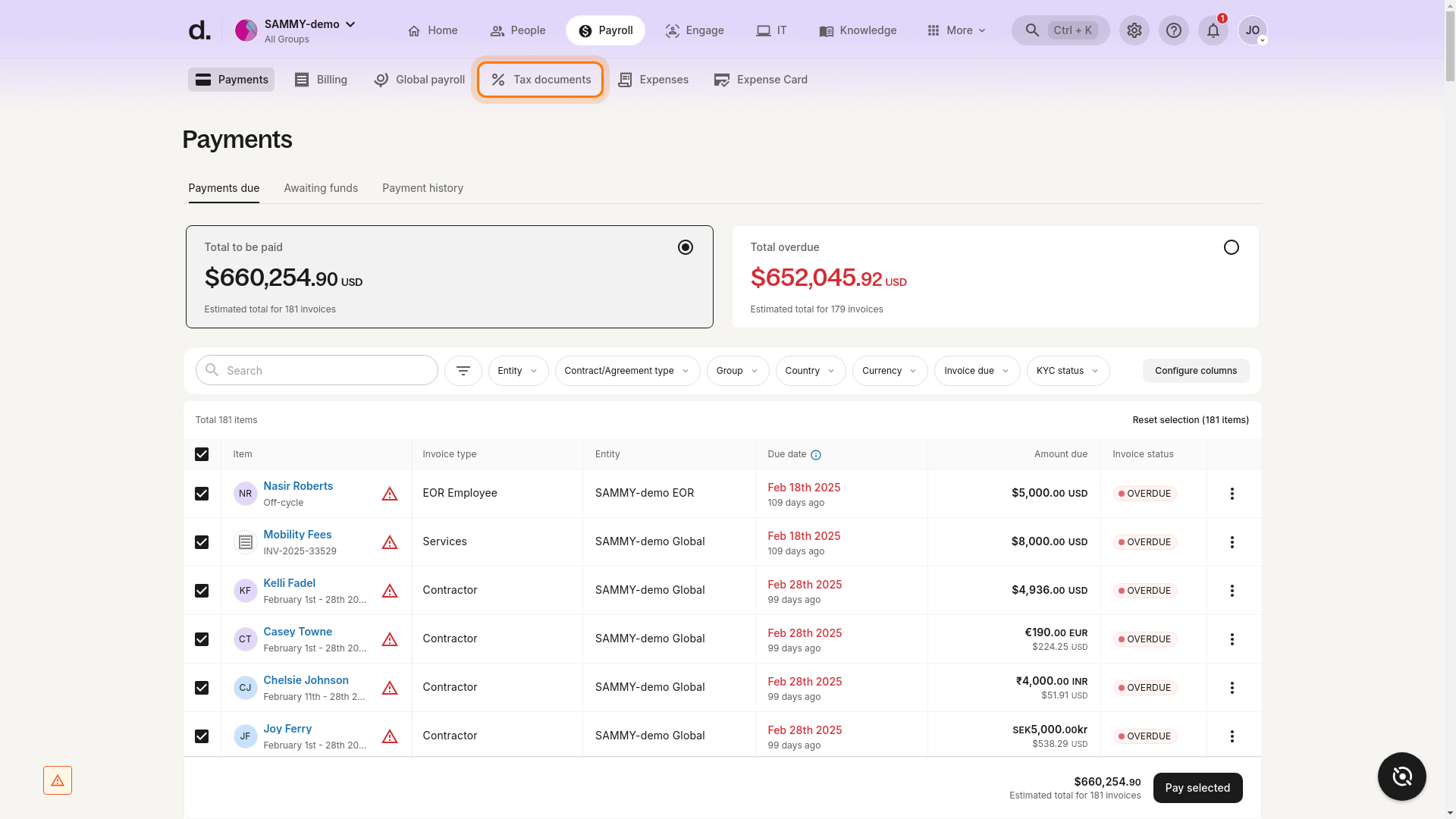

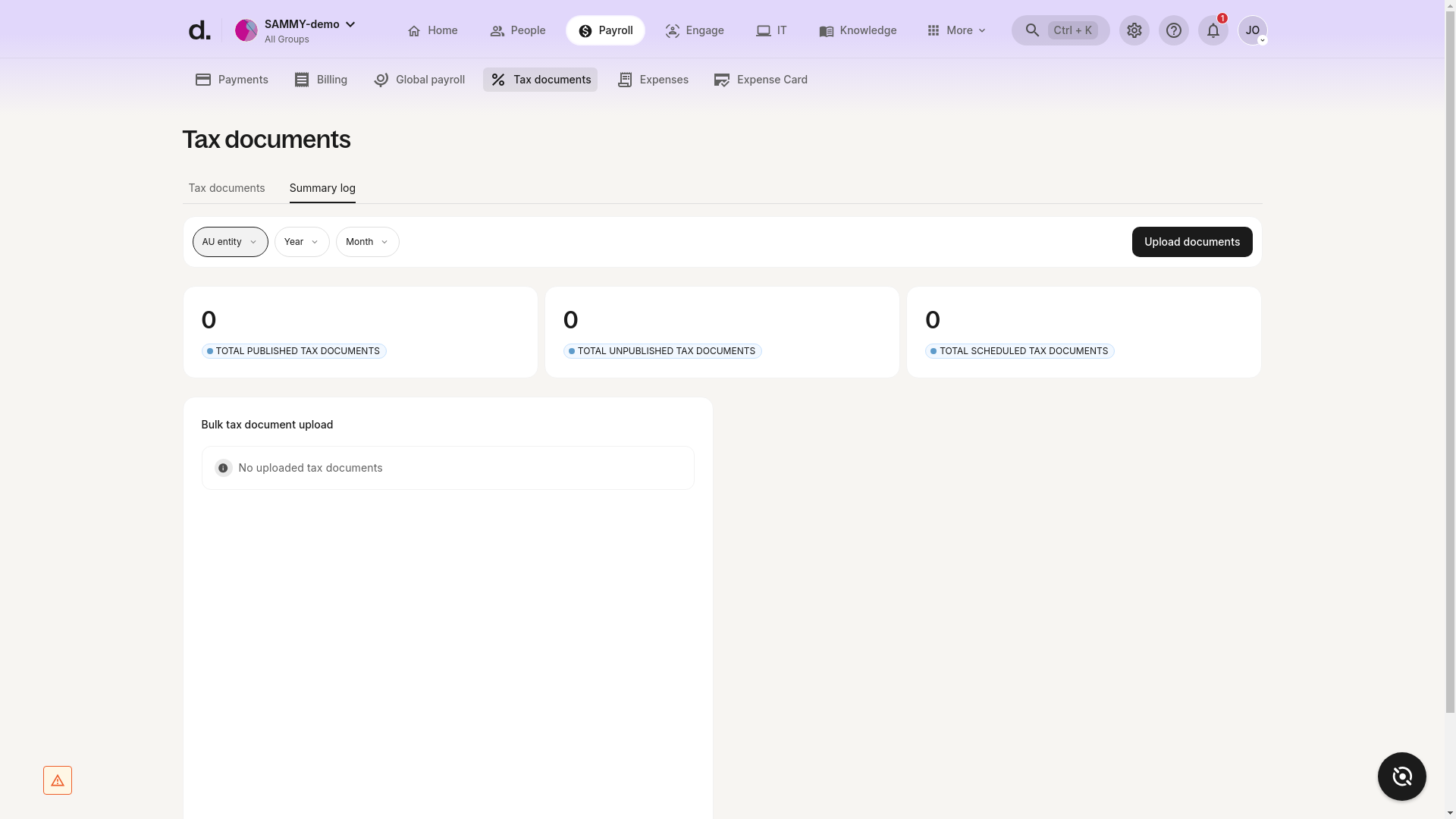

- In the Payroll section, locate and click on the Tax documents option in the navigation menu at the top of the page.

- Open the Summary Log

- By default, you will be taken to the Summary log tab within the Tax documents section. This is where all available tax documents are listed.

- Check for Available Tax Documents

- Review the Summary log for any available tax documents. In this example, the system displays:

- 0 Total published tax documents

- 0 Total unpublished tax documents

- 0 Total scheduled tax documents

- A message: "No uploaded tax documents"

-

If tax documents are available, they will be listed here. If not, you will see a message indicating that no documents are available.

-

Download the Tax File (If Available)

- If a tax document is listed, click View next to the desired file to open it.

- Then, select Download to save the tax file to your device.

- If no documents are listed, you will not be able to proceed with viewing or downloading.

Verification and Success Criteria

- Success: You have successfully navigated to the Tax documents > Summary log section. If tax documents are available, you are able to view and download them. If no documents are available, the system will display a message such as "No uploaded tax documents."

Troubleshooting

- No tax documents are listed:

- Confirm with your administrator that quarterly tax forms have been published for your entity.

- Ensure you have the correct permissions to access tax documents.

- Tax documents may only be available after the end of each quarter; check back later if you expect documents to be published soon.

- Cannot download:

- If the download option is not available, verify that the document is published and visible in the Summary log.

Additional Notes

- The appearance and availability of tax documents may vary depending on your organization’s settings and the timing of document publication.

- All screenshots in this guide are for illustrative purposes and may show example data or empty states depending on your account’s current status.